After reading some books on fundamental analysis, I learned that financial ratios are so important to understand how a company is performing. I started to look for more resources online finding the information I need.

One of the books suggesting the financial requirements as follow:

- Annual Revenue Growth > 0% and Current data > Last Year;

- Net Profit Margin – Average 3 Year & Average 5 Year > 10%;

- ROE – Average 3 Year & Average 5 Year > 15%;

- Debt Ratio < 0.5;

- Free Cash Flow > 0;

- Operating Cash Flow to Net Income Ratio > 0.5;

- Dividend – Current > Average 3 Years > Average 5 Years;

- Dividend Yield > 6%.

I first tried to utilize the stock screeners from different sources to minimize the list of possible companies that met the criteria above. Then, I went through the already calculated financial ratios provided from those sources and determine which companies met the most requirements.

However, after generating a list from stock screeners, it still took me a long time to calculate most the ratios because every source does not provide every one I needed. I had to calculate the missing ones manually even though there were only approximately 10 companies after screening. As I mentioned previously, I worked more than 10 hours a day and I had a baby to take care. I did not have the time to do that much calculation every time I screen a list of companies.

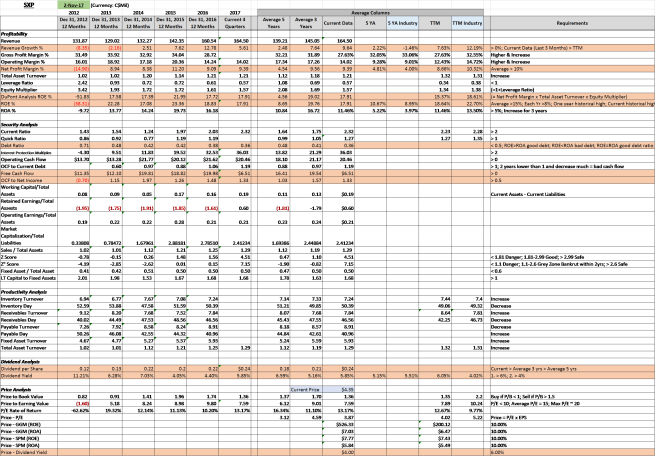

Therefore, I decided to generate an Excel Spreadsheet template that I can just plug in the financial statements and it will calculate all the criteria for me. Below is the sample of the first spreadsheet I generated:

It has all the financial ratios I need learning from different books. I also include the average columns for 3 years and 5 years. I also have a columns comparing the financial to the industry average. The last column is the criteria I would follow so that I do not have to go back to the books every time.

After having the spreadsheet template, I can generate a company’s financial status in 5 minutes by pulling the financial statements online and paste them into the template. Furthermore, I can spend most of the time focusing on reviewing the numbers and company’s financial reports instead of wasting time to do calculation.

This template helps me to see the big picture of a company quantitatively before I spend time to understand the company in a more qualitative perspectives.

Continue to: Second Approach – Supremex Inc. (SXP).